If you need to make payments greater than $50,000, TransferWise is the clear winner. And as we saw above, TransferWise is generally cheaper than Xoom even at lower transaction amounts. For businesses that need to process a high volume of small payments or a few large payments, the cost-savings could add up quickly.

Similarly, What is the cheapest way to wire money internationally?

In almost every case, the cheapest way to transfer money internationally is to use a specialist money transfer service. They provide much more competitive rates, fees, and commissions than banks or PayPal, meaning your recipient will end up with more money.

What is better than Xoom? 1. Wise. Wise is a decade younger than Xoom, set up in 2011. It was created to offer an alternative to the expensive and time-consuming process of transferring money through the banks, so instead of relying on wire transfers between each country, Wise uses a network of local bank accounts in countries around the world.

Thereof, Which is better Xoom or Remitly?

Bottom line. Remitly beats out Xoom in saving you money, but both are pretty evenly matched when it comes to speed. The fact that Remitly’s exchange rates are generally (but not always) slightly better means that it comes out on top almost every time.

What is cheaper than TransferWise?

WorldFirst is one of the alternatives to TransferWise in the UK, Singapore, Australia and New Zealand. It is the best alternative for UK residents. WorldFirst also has an alternative to the TransferWise Borderless account. The WorldFirst World Account offers currency local bank account details than WorldFirst.

Which bank is best for international wire transfers?

Best banks for international travel

- Charles Schwab Bank: Best for using ATMs.

- Capital One 360: Best on foreign transaction fees.

- HSBC Bank: Best for expats.

- Citibank: Best for wiring money.

Is Western Union cheaper than bank transfer?

Money transfer services can cost less than bank fees

For example, with Western Union, you can send money online to bank accounts around the world for no transfer fee when you pay with POLi. You can also take advantage of no transfer fees for international bank transfers over $5,000.

Is TransferWise legal?

We are an Electronic Money Institution authorised by the UK Financial Conduct Authority (“FCA”) under the Electronic Money Regulations 2011 for the issuing of electronic money and providing payment services. Our FCA reference number is 900507.

What is cheaper than Xoom?

Comparing Fees Between MoneyGram, PayPal, and Xoom

As a rule of thumb, PayPal is the best option to transfer money between bank accounts, MoneyGram or Xoom are usually cheaper for transferring money from a sender’s debit or credit card to a recipient’s bank account, and MoneyGram has no fee for international transfers.

Is WorldRemit better than Remitly?

In a nutshell: Both are leaders when it comes to smaller amounts including bank transfers, mobile wallet transfers and cash pick up. Remitly offers home delivery while WorldRemit offers prepaid mobile top ups. WorldRemit offers slightly better fees and also offers a business option.

Is Zoom a wire transfer?

Zoom accepts manual payments by check, wire/bank transfer, EFT, and ACH.

What is better than Remitly?

According to the Monito Score, Wise is also ranked as the best money transfer service of all, and its mobile app is rated the best money transfer app. Wise is usually a better deal than Remitly, but certainly not for every transfer. What’s more, only Remitly offers cash pay-outs.

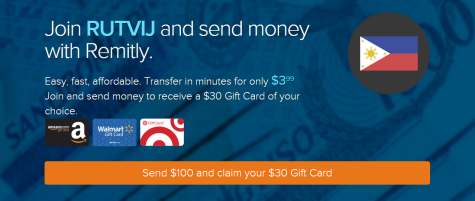

Is Remitly cheaper than PayPal?

Remitly saves you money in the end, as both the fee and exchange rate are better. Remitly charges a lower fee, and its Philippine peso exchange rate is better than PayPal’s .

…

Sending $1,000 to the Philippines.

| Remitly | PayPal | |

|---|---|---|

| Exchange rate | 1 USD = 50.58 PHP | 1 USD =49.7517 PHP |

| Transfer speed | Same day | Same day |

• 13 févr. 2021

Is Xoom cheaper than Remitly?

At the time of writing, a direct bank payment via Remitly would cost $3.60 in total fees, while a bank transfer with Xoom would cost $3.99 plus an exchange rate that’s 2.41% worse than the mid‑market rate .

…

Remitly vs Xoom: Fees & Exchange Rates.

| Remitly | Xoom | |

|---|---|---|

| % Competitive (Cash) | 37% | 9% |

| Try Remitly | Try Xoom |

What is the best alternative to TransferWise?

Top 10 Alternatives to TransferWise

- Remitly.

- mPayX – Money Transfer Software.

- Money Transfer System.

- Sila.

- Veem.

- Vayupay.

- Azimo.

- OFX.

Who is better than TransferWise?

Article summary:

| Alternative | Hidden Conversion Fee* | Benefits compared with Wise (formerly Transferwise) |

|---|---|---|

| Payoneer | 1-3% | They have a debit card where the recipient can receive money from an ATM |

| PayPal | 2.5-4% | Convenient |

| MoneyGram | 1-3% | Recipient can get the money in cash |

| Banks | 1-5% |

• 2 févr. 2017

Who owns TransferWise?

Wise founders Taavet Hinrikus, left, and Kristo Käärmann. LONDON — The founders of money transfer service Wise are now billionaires — on paper, at least. The British fintech company formerly known as TransferWise went public on the London Stock Exchange Wednesday, in a direct listing valuing the company at $11 billion.

Which bank has the most international branches?

Citibank probably has the greatest global coverage of all multinational banks, making it the best choice for travelers who often visit a variety of destinations. Citibank operates over 1,000 branches in the US and more than 4,000 globally.

Are wire transfers over $10000 reported to the IRS?

If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.

What is the maximum wire transfer amount?

A wire transfer is an electronic transaction that facilitates sending a large amount of money in a quick fashion. Other money-transferring services have limits on how much money can be transferred, but wire transfers allow you to send more than $10,000.

Join TheMoney.co community and don’t forget to share this post !