British American Tobacco (NYSE:BTI) declares $0.735/share quarterly dividend, 1.4% increase from prior dividend of $0.725.

Similarly, Is BTI a buy or sell?

For example, a stock trading at $35 with earnings of $3 would have an earnings yield of 0.0857 or 8.57%. A yield of 8.57% also means 8.57 cents of earnings for $1 of investment.

…

Momentum Scorecard. More Info.

| Zacks Rank | Definition | Annualized Return |

|---|---|---|

| 1 | Strong Buy | 24.93% |

| 2 | Buy | 18.44% |

| 3 | Hold | 9.99% |

| 4 | Sell | 5.61% |

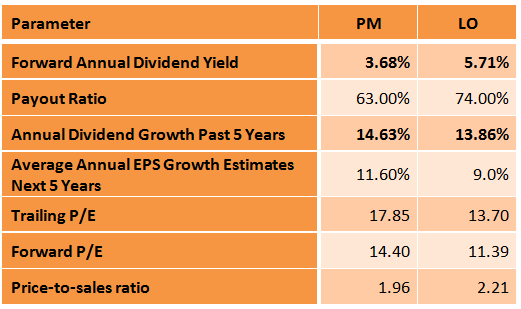

What is BTI payout ratio? BTI’s dividend payout ratio is 74.4%, which is sustainable.

Thereof, Is BTI an ADR?

BTI. N – British American Tobacco PLC (ADR) Profile | Reuters.

Is BTI a safe stock?

This is a blue-chip that’s built to last and a proven source of safe and growing income . BTI’s future is in smoke-free reduced-risk products.

…

Reason Two: One Of The World’s Greatest Companies.

| BTI | Final Score | Rating |

|---|---|---|

| Safety | 84% | 5/5 very safe |

| Business Model | 100% | 3/3 wide moat |

| Dependability | 90% | 5/5 exceptional |

• 21 févr. 2022

Is PM a buy?

Philip Morris International has received a consensus rating of Buy. The company’s average rating score is 2.63, and is based on 5 buy ratings, 3 hold ratings, and no sell ratings.

What is the best tobacco stock?

Best Tobacco Stocks Right Now

- Vector Group (NYSE: VGR) Vector Group Limited manufactures and markets cigarette products in the United States through its subsidiaries Vector Tobacco Inc. …

- British American Tobacco (NYSE: BTI) …

- RLX Technology (NYSE: RLX) …

- Philip Morris Intl (NYSE: PM) …

- Altria Group (NYSE: MO)

What is Exeff date?

The ex-dividend date for stocks is usually set one business day before the record date. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend.

Which stock has the highest dividend?

Dividend stocks can be a great choice for investors looking for regular income.

…

25 high-dividend stocks.

| Symbol | Company Name | Dividend Yield |

|---|---|---|

| CVX | Chevron Corp | 3.48% |

| PFG | Principal Financial Group Inc | 3.48% |

| DLR | Digital Realty Trust Inc | 3.44% |

| HAS | Hasbro Inc. | 3.41% |

• 1 avr. 2022

Is Altria Philip Morris?

Altria is the parent company of Philip Morris USA (producer of Marlboro cigarettes), John Middleton, Inc., U.S. Smokeless Tobacco Company, Inc., and Philip Morris Capital Corporation.

Are tobacco stocks undervalued?

British American Tobacco is an undervalued dividend powerhouse that produces a stable and secure 8.55% dividend yield. A « death company » with a growing top and bottom line might still have plenty to offer for potential investors.

Is tobacco still a good investment?

Tobacco stocks come with a number of risks, however, including increased regulation of the underlying companies and declining smoking rates. Revenue and profit growth have been slow across the industry, but these stocks still hold appeal for investors because their profits and dividends have been so reliable.

Is Altria a buy Zacks?

See rankings and related performance below. The VGM Score are a complementary set of indicators to use alongside the Zacks Rank.

…

Momentum Scorecard. More Info.

| Zacks Rank | Definition | Annualized Return |

|---|---|---|

| 1 | Strong Buy | 24.93% |

| 2 | Buy | 18.44% |

| 3 | Hold | 9.99% |

| 4 | Sell | 5.61% |

Who owns the Marlboro company?

Marlboro

| Product type | Cigarette |

|---|---|

| Owner | Altria Philip Morris International |

| Produced by | Philip Morris USA (US) Philip Morris International (outside US) |

| Country | United States |

| Introduced | 1924 |

What does Philip Morris own?

Brands. Philip Morris USA brands include Marlboro, Virginia Slims, Benson & Hedges, Merit, Parliament, Alpine, Basic, Cambridge, Bucks, Dave’s, Chesterfield, Collector’s Choice, Commander, Lark, L&M, Players. As of the 27 of December, 2018, Philip Morris also owns a minority stake in JUUL.

What companies does BTI own?

The company offers its products under the Kent, Dunhill, Lucky Strike, Pall Mall, Rothmans, Camel, Newport, Natural American Spirit, being Vapour, THP, and Modern Oral brands. It distributes its products to retail outlets.

Is there a tobacco ETF?

It’s therefore a bit surprising to find that there aren’t any ETFs specifically designed for tobacco investors. Although there are ETFs that hold tobacco stocks, you won’t find a pure-play tobacco ETF that restricts its holdings only to tobacco stocks.

What is the richest tobacco company?

Philip Morris International was the largest tobacco company worldwide in 2020, with a global market value of about 144.8 billion U.S. dollars. British American Tobacco followed in second place with a global market value of approximately 91.6 billion U.S. dollars.

Is it good to buy stock on ex-dividend date?

Waiting to purchase the stock until after the dividend payment is a better strategy because it allows you to purchase the stock at a lower price without incurring dividend taxes.

Can I sell stock on ex-dividend date and still get dividend?

The ex-dividend date is the first day of trading in which new shareholders don’t have rights to the next dividend disbursement. However, if shareholders continue to hold their stock, they may qualify for the next dividend. If shares are sold on or after the ex-dividend date, they will still receive the dividend.

How do I find the ex-dividend date?

Existing shareholders of a company’s stock receive notification, typically by mail, when the company declares a dividend payment. Included in the information, along with the amount of the dividend, the record date, and the payment date is the ex-dividend date.

Join TheMoney.co community and don’t forget to share this post !