Currently, there are no Target Retirement Date ETFs open in the market.

Similarly, What is a 2040 fund?

Target Date portfolios provide a diversified exposure to stocks, bonds, and cash for those investors who have a specific date in mind (in this case, the years 2036-2040) for retirement or another goal.

Is a target-date fund an index fund? Target-date funds are a variety of actively managed fund that are designed to “mature” at a specific time. Passively managed index funds simply buy and hold a basket of securities that also fit the fund’s objective without any portfolio turnover.

Thereof, What ETFs hold target?

Unlock all 369 ETFs with exposure to Target Corporation (TGT)

| Ticker | ETF | Weighting |

|---|---|---|

| XLY | Consumer Discretionary Select Sector SPDR Fund | 2.66% |

| JHMC | John Hancock Multifactor Consumer Discretionary ETF | 2.59% |

| QUAL | iShares MSCI USA Quality Factor ETF | 2.40% |

| QGRO | American Century STOXX U.S. Quality Growth ETF | 2.39% |

Are Target-Date Funds better than index funds?

Key Takeaways. Index funds offer more choices and lower costs, while a target-date fund is an easy way to invest for retirement without worrying about asset allocations. Index funds include passively-managed exchange-traded funds (ETFs) and mutual funds that track specific indexes.

What is a 2030 fund?

The 2030 fund invests in four Vanguard index funds. This fund is most appropriate for people planning to retire between 2028 and 2032. As of March 17, 2022, the fund has assets totaling almost $87.26 billion invested in 6 different holdings. Its portfolio tracks U.S. and international total stock and bond markets.

What is Vanguard Target retirement 2040 Select?

Vanguard Target Retirement 2040 Trust Select seeks to provide capital appreciation and current income consistent with its current asset allocation.

Are Target Date Funds index funds?

Target-date funds are a variety of actively managed fund that are designed to “mature” at a specific time. Passively managed index funds simply buy and hold a basket of securities that also fit the fund’s objective without any portfolio turnover.

What kind of fund is a target-date fund?

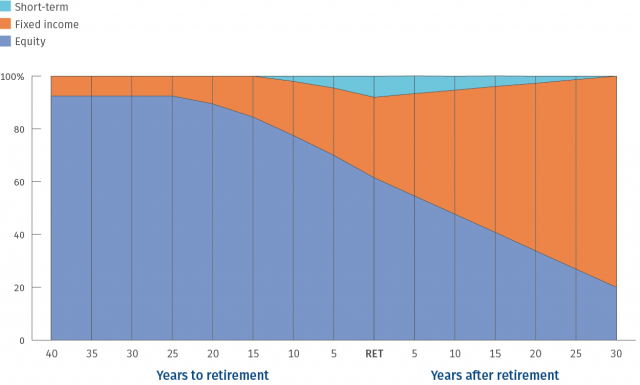

A target-date fund is a class of mutual funds or ETFs that periodically rebalances asset class weights to optimize risk and returns for a predetermined time frame.

How do target-date funds work?

Target-Date Funds: An Overview

Also referred to as life-cycle funds or age-based funds, the concept is simple: Pick a fund, put as much as you can into the fund, then forget about it until you reach retirement age. Of course, nothing is ever as simple as it seems.

How much should I invest in target-date fund?

Each fund is designed to manage risk while helping to grow your retirement savings. The minimum investment per Target Retirement Fund is $1,000.

What ETF holds Costco?

Unlock all 352 ETFs with exposure to Costco Wholesale Corporation (COST)

| Ticker | ETF | Weighting |

|---|---|---|

| VDC | Vanguard Consumer Staples ETF | 7.83% |

| IEDI | iShares Evolved U.S. Discretionary Spending ETF | 7.24% |

| JHMS | John Hancock Multifactor Consumer Staples ETF | 6.40% |

| MILN | Global X Millennial Consumer ETF | 5.94% |

Is QQQ a target?

For the Invesco QQQ ETF (Symbol: QQQ), we found that the implied analyst target price for the ETF based upon its underlying holdings is $434.35 per unit.

…

Peek Under The Hood: QQQ Has 11% Upside.

| Name | Invesco QQQ ETF |

|---|---|

| Symbol | QQQ |

| Recent Price | $389.91 |

| Avg. Analyst 12-Mo. Target | $434.35 |

| % Upside to Target | 11.40% |

• 3 déc. 2021

What mutual funds hold target?

Top 10 Mutual Funds Holding Target Corp

| Mutual fund | Stake | Shares bought / sold |

|---|---|---|

| Vanguard Total Stock Market Index… | 2.87% | +6,903 |

| Vanguard 500 Index Fund | 2.21% | +231,229 |

| SPDR S&P 500 ETF Trust | 1.09% | +287 |

| Fidelity 500 Index Fund | 1.04% | +75,385 |

Are target-date funds too conservative?

On average, target-date funds held by employees who are in their 30s hold 89% of their assets in equities. That figure mirrors the authors’ estimates. For older investors, target-date funds are too conservative. Target-date 2035 funds, which address 50-year-old investors, are 68% invested in stocks.

Is it better to invest in target-date funds?

They are a good option for investors who are hands off and who wouldn’t rebalance their investments on their own. Target date funds are also good for DIY investors, because they are a more comprehensive strategy than picking on past performance, which is the way do-it-yourselfers often pick investments.

Where do you put 50k?

Here are ten ways to invest 50k.

- Invest with a Robo Advisor. One of the easiest ways to start investing is with a robo advisor. …

- Individual Stocks. Individual stocks represent an investment in a single company. …

- Real Estate. …

- Individual Bonds. …

- Mutual Funds. …

- ETFs. …

- CDs. …

- Invest in Your Retirement.

What is American Funds Target Date?

The American Funds Target Date Retirement Series® is a professionally managed collection of mutual funds designed to help you invest for retirement and meet your changing financial needs over time.

What is Vanguard Target retirement 2040 Trust Plus?

Vanguard Target Retirement 2040 Trust Plus is one of a series of Vanguard life-cycle trusts that use a targeted maturity approach as a simplified way to meet investors’ different objectives, time horizons, and changing risk tolerances.

How do target date funds work?

Target-date funds are designed to help manage investment risk. You pick a fund with a target year that is closest to the year you anticipate retiring, say a « 2050 Fund. » As you move toward your retirement « target date, » the fund gradually reduces risk by changing the investments within the fund.

Is Vforx a mutual fund?

VFORX – Profile

The fund invests in a mix of Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2040 (the target year).

Join TheMoney.co community and don’t forget to share this post !