How to Get Free Virtual Credit/Debit Cards in India

- a) FreeCharge Go Master Card. FreeCharge is an e-commerce website headquartered in Mumbai, Maharashtra. …

- b) Pockets Wallet by ICICI Banks. …

- c) Lime Wallets by Axis Bank. …

- d) Slonkit Prepaid Wallets. …

- e) Entropay Virtual International Visa Card.

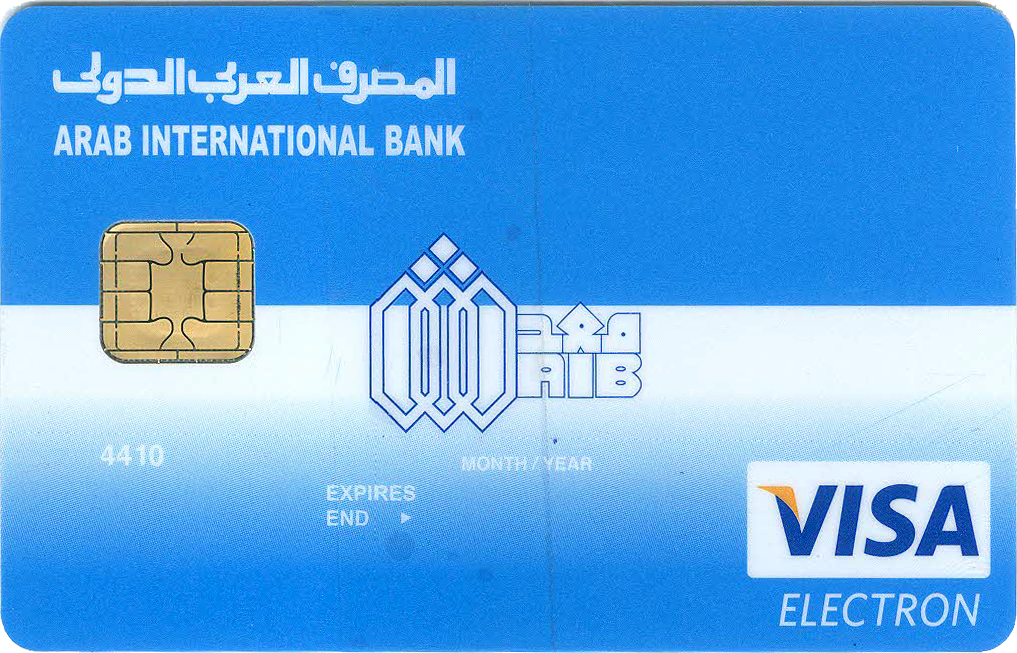

D’une part, Does Visa Electron still exist? Visa is discontinuing Visa Electron globally1 and requiring it to be replaced with Classic or higher. Visa Electron offers limited functionality and has been superseded by more comprehensive product offerings that also include the control elements of Visa Electron.

D’autre part, Is Visa Electron the same as Visa?

Visa Electron is a debit card available across most of the world, with the exception of Canada, Australia, Ireland and the United States. It was introduced in 1985. The difference between Visa Electron and Visa Debit is that Visa Electron card doesn’t allow overdraft.

Can I buy a Visa card without a fee? The answer is no. Visa, Mastercard®, American Express® and other bank-issued gift cards charge a purchase fee to cover the money they have to pay to third parties like the store, the program manager, and the processor.

Ainsi, Does PayPal have Virtualcards? PayPal Key provides a virtual card number that lets you shop anywhere online that accepts Mastercard. When you use PayPal Key for phone purchases, just provide the virtual card number, expiration date, and security code, just like you’d do with a regular credit card purchase.

Does venmo have virtual cards?

When you open a Venmo credit card account, you get a physical card in the mail, but a separate “virtual card” — with a virtual number — to use online. If your virtual card is ever compromised when you’re shopping online, you can request a new number directly in the Venmo app.

Does Google Pay have a virtual card?

The new Google Pay card is a virtual Visa debit card that you can set as an NFC card, so now spending that money a friend sent you is as easy (and presumably quick) as setting your Google Pay balance as your NFC card and tapping your phone against a store payment terminal.

How do I get a virtual credit card number?

Log into your online credit card account and go to your account settings. For issuers like Capital One and Citibank, there will be a “Virtual Card Numbers” option for you to select. For other issuers, search for “virtual credit card” and the specific benefit for your issuer should pop up.

How do I qualify for a PayPal key?

If you are an individual, you must be a resident of the United States or one of its territories and at least 18 years old, or the age of majority in your state of residence to open a U.S. PayPal account and use the PayPal services.

Can I borrow money on Venmo?

How to Borrow Money from Venmo? Yes, you can borrow money from Venmo and get Venmo loans up to $5,000. And much like regular bank loans, Venmo will take a small amount from your cash balance every month as an interest fee until you fully pay the loan back.

Does PayPal give cash advances?

Can You Do A Cash Advance With Paypal? You can make a Cash Advance using this account by choosing Send Money as your payment method. By authorizing PayPal, Inc., we will grant you credit for the Cost of the Cash Advance in the amount of the Cash Advance.

Can I add virtual visa to Google Pay?

You are able to add your temporary virtual or physical ONE card to Google Pay via your ONE app. Keep in mind that per Pocket virtual cards are not able to be added to Google Pay. For your virtual card, the merchant must run the payment as Credit for transactions to go through.

Which is better PayPal or Google Pay?

PayPal incurs a debit fee of 2.9% of the debited value plus $0.30 as an additional fee. Google Pay rewards their users with periodic cashbacks and transaction refunds as well as vouchers from deemed e-commerce websites. PayPal is more accepted than Google Pay globally as it enables hassle-free fund transfer worldwide.

What is a venmo debit card?

The Venmo Mastercard® Debit Card is a debit card that operates on the Mastercard network. It is linked to your Venmo account and allows you to spend your Venmo balance funds everywhere Mastercard is accepted in the U.S. and in U.S. territories.

Who offers virtual credit card?

Answer: Only three banks in the United States offer virtual credit cards to their customers. They are Citibank, Bank of America, and Capital One.

Is Eno Capital One Free?

To use virtual card numbers from Eno2, start by adding Eno to your desktop browser (it’s free!). After signing into the browser extension and enrolling, Eno will appear at checkout and allow you to create unique, merchant-specific virtual card numbers linked to your Capital One credit card account.

How do I create a virtual card?

Steps to create a Virtual Card

- Visit the State Bank of India Internet Banking page.

- Login using your username and password.

- Click on the “e-card” tab on the top bar.

- Once you have done that, click on “generate virtual card’.

- Now, select the account you wish to transfer money to the Virtual Card.

How do I get a virtual prepaid card?

Following are the steps to get a virtual credit card:

- Step 1) Get a Credit card.

- Step 2) Log into your credit card account online and go to its settings.

- Step 3) Download the virtual card issuer’s app if needed and log into the app.

- Step 4) Search for a Virtual credit card and access the card number.

Why was PayPal Key discontinued?

Federal tax payment processors didn’t like that either, so towards the end of 2020 that option was ixnayed too. There were occasionally other issues too. Some people were unable to set up a PayPal Key in the first place.

What happened PayPal key?

Here’s PayPal’s statement: “As of March 1, 2022, PayPal discontinued offering the PayPal Key feature for new customers in the U.S. On April 21, 2022, PayPal will remove the PayPal Key feature for all existing customers and any new transactions using their virtual card number will be declined.”

What app will give me money instantly?

1. Earnin – Best for hourly workers. Earnin is an app that allows you to borrow against your next paycheck quickly without any fees or interest payments attached. When users sign up for the app, Earnin connects their bank accounts to verify their payment schedules.

What app will let me borrow money?

Here are five apps that let you borrow against future earnings, and some less expensive options to consider.

- Earnin: Best for low fees.

- Dave: Best for small advances.

- Brigit: Best for budgeting tools.

- Chime: Best for overdraft protection.

- MoneyLion: Best for multiple financial products.

What app gives you 100 dollars?

Klover gives you a $100 instant cash advance before you get paid. No credit check.

What apps will spot you money?

Here are the best borrow money and paycheck cash advance apps you can use right now:

- Wealthfront Cash Account. Wealthfront is one of the best robo-advisors out there.

- Chime.

- Empower.

- Axos Bank Direct Deposit Express.

- Earnin.

- DailyPay.

- PayActiv.

- FlexWage.

Can I borrow money from PayPal Credit?

It is not possible to advance money on your own: PayPal Credit’s cash advance feature allows users to send money to friends or family; you cannot use this feature to send money on your own. You can use the money you advance on your credit card immediately since you are getting money directly from the bank.

How can I get money from PayPal instantly?

Select Transfer from PayPal to your bank in the Transfer money screen. The next screen shows your options: Instant: PayPal transfers your money instantly for 1 percent of the amount being transferred. Standard: Withdraw the entire balance or part of it free of charge.

How do I use a virtual Visa card?

Anyone with a Visa credit card can use a virtual Visa credit card number through the free digital card service Click to Pay with any online merchant that shows the EMV payment icon at checkout.

How do I use my virtual Visa card in store?

A virtual debit card can be used just like you would use a physical bank card. In addition to online purchases, you can use a virtual card for contactless payments in stores by adding it to Apple Pay or Google Pay. Some even allow you to withdraw money from ATMs.

Does Apple Pay use virtual card number?

Open the Settings App. Scroll down and tap Wallet & Apple Pay. Tap Apple Card, then tap the Info tab. Tap Card Information, then authenticate with Face ID, Touch ID, or your passcode to see your virtual card number.

N’oubliez pas de partager l’article !