Correspondingly, How long is a candle in crypto? Each candlestick typically represents one, two, four or 12 hours. (A longer-term trader will likely choose to observe candlesticks that represent a single day, week or month.) A candlestick becomes « bullish, » typically green, when the current or closing price rises above its opening price.

Is candlestick trading profitable? Conclusion. Candlestick trading can be profitable, but you have to know what you’re looking at and when specific patterns aren’t going to work. Candlestick trading is subjective, but you may find that they work well for you if you know what filters to add to the charts.

Furthermore, How do you remember candlestick patterns?

What do stock candles mean?

Candlestick charts display the high, low, open, and closing prices of a security for a specific period. Candlesticks originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States.

How do you read candles? If the upper shadow on a down candle is short, it indicates that the open that day was near the high of the day. A short upper shadow on an up day dictates that the close was near the high. The relationship between the days open, high, low, and close determines the look of the daily candlestick.

What is the best candlestick pattern to trade? We look at five such candlestick patterns that are time-tested, easier to spot with a high level of accuracy.

- Doji. These are the easiest to identify candlestick pattern as their opening and closing price are very close to each other. …

- Bullish Engulfing Pattern. …

- Bearish Engulfing Pattern. …

- Morning Star. …

- Evening Star.

How do I learn crypto charts? Understanding support and resistance are one of the most crucial parts of reading a crypto chart. Support levels in charts refer to a price level that the asset does not fall below for a fixed period. In contrast, resistance level refers to the price at which the asset is not expected to rise any higher.

Does Warren Buffett use technical analysis?

Does Warren Buffet use technical analysis? The answer is: No. I have not read anything that suggests he takes the help of charts for his investing.

Which candlestick pattern is most profitable? Although there are well-performing candlestick patterns, we recommend adding other confluence factors to create a robust price action trading system.

- 1 – Bearish Three Line Strike. …

- 2 – Three Black Crows. …

- 3 – Bullish Abandoned Baby. …

- 4 – Evening Star. …

- 5 – Two Black Gapping. …

- 6 – Inverted Hammer. …

- 7 – Bullish Three Line Strike.

What is the most powerful candlestick pattern?

1. Doji. Considered to be one of the most important single candlestick patterns, the doji can give you an insight into the market sentiment. Dojis are said to be formed when the opening price and the closing price of a stock are the same.

How can you tell if a candle is bullish? A black or filled candlestick means the closing price for the period was less than the opening price; hence, it is bearish and indicates selling pressure. Meanwhile, a white or hollow candlestick means that the closing price was greater than the opening price. This is bullish and shows buying pressure.

How do you read a Japanese candlestick chart?

What is bullish Harami?

A bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. It is generally indicated by a small increase in price (signified by a white candle) that can be contained within the given equity’s downward price movement (signified by black candles) from the past couple of days.

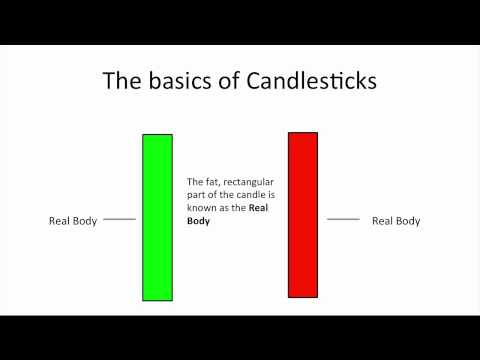

How do candlestick charts predict stock prices? Each candlestick represents one day’s worth of price data about a stock through four pieces of information: the opening price, the closing price, the high price, and the low price. The color of the central rectangle (called the real body) tells investors whether the opening price or the closing price was higher.

Which candlestick pattern is bullish?

The Bullish Morning Star is a three-candlestick pattern. It signals a major bottom reversal. In this pattern, a black candlestick is followed by a short candlestick, which usually gaps down to form a Star. The third white candlestick’s closing is well into the first session’s black body.

How do you read a candle wick?

Which time frame is best for day trading?

It is always better to strategically invest your time. A lot of research has suggested that the best time frame for intraday trading is usually between 9:30 am-10:30 am. If you are a beginner, it is always better that you observe the market for the first 15 minutes and then start trading.

Which candlestick pattern is most bullish? We will focus on five bullish candlestick patterns that give the strongest reversal signal.

- The Hammer or the Inverted Hammer. Image by Julie Bang © Investopedia 2021. …

- The Bullish Engulfing. Image by Julie Bang © Investopedia 2020. …

- The Piercing Line. …

- The Morning Star. …

- The Three White Soldiers.