Dividend Summary

There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 1.0.

Similarly, Is EPD a k1?

HOUSTON, February 28, 2022–(BUSINESS WIRE)–Enterprise Products Partners L.P. (NYSE: EPD) today announced that its 2021 tax packages, including schedule K-1’s are now available online. They may be accessed through the K-1 Tax Package Support website, www.taxpackagesupport.com/enterprise.

What is the payout ratio of EPD? EPD Dividend Safety Grade

| EPD | EPD 5Y Avg. | |

|---|---|---|

| Dividend Payout Ratio (TTM) (Non GAAP) | 82.22% | 99.84% |

| Dividend Payout Ratio (FY1) (Non GAAP) | 83.81% | 95.12% |

| Cash Flow Payout Ratio (TTM) | 46.98% | 64.82% |

| Cash Flow Payout Ratio (FY1) | 58.96% | 64.91% |

• 29 mars 2022

Thereof, Does nly pay monthly dividends?

The previous Annaly Capital Management Inc dividend was 22c and it went ex 3 months ago and it was paid 2 months ago. There are typically 4 dividends per year (excluding specials).

…

Dividend Summary.

| Summary | Previous dividend | Next dividend |

|---|---|---|

| Pay date | 31 Jan 2022 (Mon) | 29 Apr 2022 (Fri) |

How long has EPD been paying a dividend?

Historical dividend payout and yield for Enterprise Products Partners (EPD) since 2000. The current TTM dividend payout for Enterprise Products Partners (EPD) as of April 08, 2022 is $1.86.

Is EPD overvalued?

Taking into account its current price per share of $24, its lower-than-usual market cap of almost $53 billion, and its promising earnings forecasts, EPD is currently undervalued.

Is EPD undervalued?

EPD is materially undervalued and currently trading below 6x cash flows with an 8.2% yield.

How is EPD Stock taxed?

Primarily, as Larry Edelson of EdelsonInstitute.com explains, the federal government doesn’t tax an MLP’s income and losses at the entity level. Instead, they are “passed through” to the shareholders (partners). Thus, a shareholder of EPD stock avoids the double taxation inherent among standard corporate equities.

How secure is EPD dividend?

EPD units have a current yield of 7.08%, which is very attractive for income investors. However, equally important is that the distribution payout is secure with underlying cash flow, along with a high likelihood of distribution increases each year.

How much does NLY pay per share?

NLY pays a dividend of $0.88 per share.

Is NLY a good dividend stock?

NLY, NRZ, LUMN, OMF, and TFSL are top by forward dividend yield.

Is NLY a buy?

NLY is currently trading at a good value due to investors paying less than what the stock is worth in relation to its earnings. NLY’s trailing-12-month earnings per share (EPS) of 1.93 does justify its share price in the market.

Is EPD stock overvalued?

Taking into account its current price per share of $24, its lower-than-usual market cap of almost $53 billion, and its promising earnings forecasts, EPD is currently undervalued.

Who owns EPD?

Institutional ownership of EPD stands at $527.5 million shares or 24.24% of shares outstanding. This is in-line with the Oil & Gas Pipelines industry average.

…

Top 10 Owners of Enterprise Products Partners LP.

| Stockholder | ALPS Advisors, Inc. |

|---|---|

| Stake | 1.10% |

| Shares owned | 23,889,193 |

| Total value ($) | 616,580,071 |

What type of company is EPD?

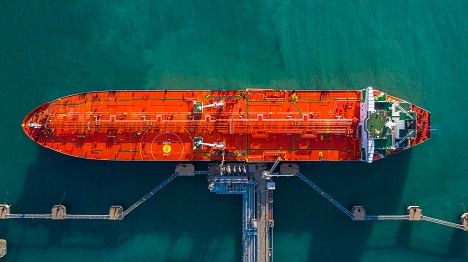

Enterprise Products Partners L.P. (NYSE: EPD) is an American midstream natural gas and crude oil pipeline company with headquarters in Houston, Texas.

…

Enterprise Products.

| Type | Public |

|---|---|

| Traded as | NYSE: EPD |

| Industry | Oil and gas |

| Founded | 1968 |

| Headquarters | Enterprise Plaza Houston, Texas , United States |

Is EDP a buy?

EDP – Energias de Portugal has received a consensus rating of Buy. The company’s average rating score is 3.00, and is based on 7 buy ratings, no hold ratings, and no sell ratings.

Is EPD stock risky?

At north of 8.5% and covered over 1.6 times by distributable cash flow, EPD is a very safe high-yield income vehicle. On top of that, its enterprise value to EBITDA multiple of nine times stands at a steep discount to its five year average of 11.5 times.

Does EPD have preferred stock?

Enterprise Products Partners annual total common and preferred stock dividends paid for 2019 were $-3.946B, a 3.61% increase from 2018.

…

Compare EPD With Other Stocks.

| Enterprise Products Partners Annual Total Common and Preferred Stock Dividends Paid (Millions of US $) | |

|---|---|

| 2018 | $-3,809 |

| 2017 | $-3,619 |

| 2016 | $-3,348 |

| 2015 | $-2,992 |

Is IEP stock a good buy?

The financial health and growth prospects of IEP, demonstrate its potential to underperform the market. It currently has a Growth Score of F. Recent price changes and earnings estimate revisions indicate this stock lacks momentum and would be a lackluster choice for momentum investors.

How is IEP stock taxed?

Icahn Enterprises L.P. is a publicly traded partnership and is currently taxed as a partnership-not as a corporation.

Join TheMoney.co community and don’t forget to share this post !