Is 2.875 a good mortgage rate? Yes, 2.875 percent is an excellent mortgage rate. It’s just a fraction of a percentage point higher than the lowest–ever recorded mortgage rate on a 30-year fixed-rate loan.

Similarly, What is a good interest rate on a house right now?

Compare California mortgage rates for the loan options below .

…

Conventional fixed-rate mortgages.

| Term | Rate | APR |

|---|---|---|

| 30-year fixed | 5.0% | 5.076% |

| 20-year fixed | 4.625% | 4.727% |

| 15-year fixed | 3.99% | 4.118% |

| 10-year fixed | 3.875% | 4.059% |

Are mortgage rates low right now? The current rate for a 30-year fixed-rate mortgage is 5.00% with 0.8 points paid, an increase of 0.28 percentage points week-over-week. The 30-year rate averaged 3.04% this week last year. The current rate for a 15-year fixed-rate mortgage is 4.17% with 0.9 points paid, up by 0.26 percentage points from last week.

Thereof, What are mortgage rates today UK?

Fixed-rate mortgages

| Mortgage | Initial interest rate | Followed by a Variable Rate, currently |

|---|---|---|

| 3 Year Fixed Standard | 2.19% fixed | 3.79% |

| 5 Year Fixed Fee Saver | 2.54% fixed | 3.79% |

| 5 Year Fixed Standard | 2.19% fixed | 3.79% |

| 5 Year Fixed Premier Standard | 2.16% fixed | 3.79% |

Will interest rates go down in 2021?

Average 30-Year Fixed Rate

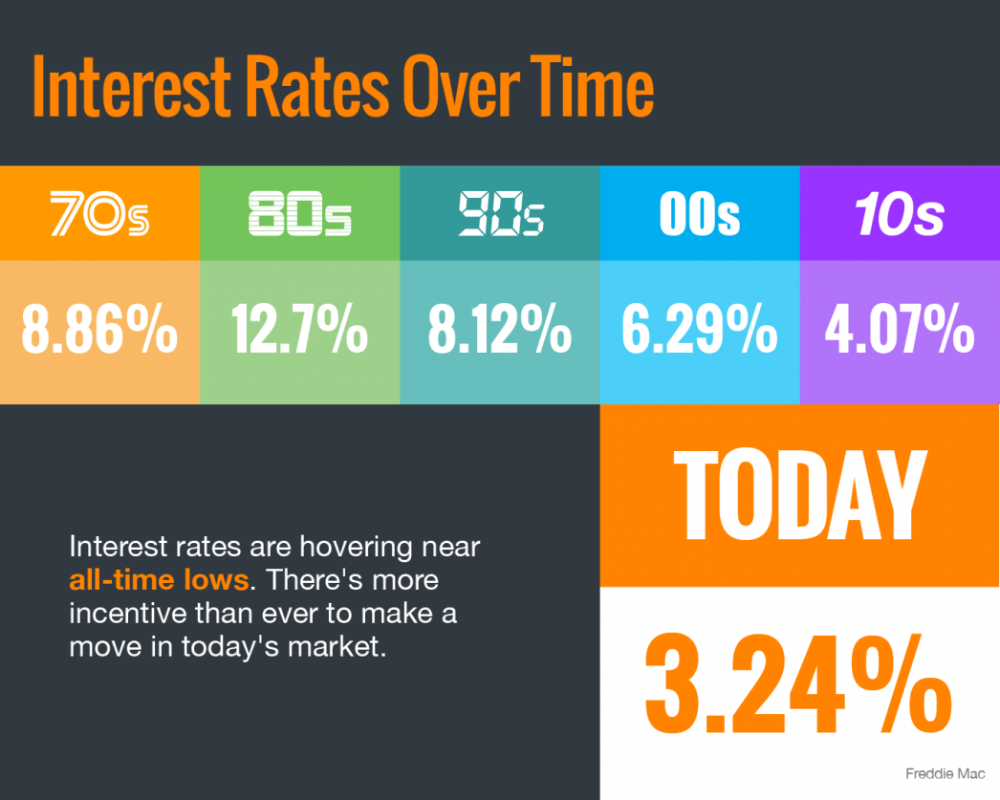

Mortgage rates are moving away from the record–low territory seen in 2020 and 2021 but are still low from a historical perspective. Dating back to April 1971, the fixed 30–year interest rate averaged 7.79%, according to Freddie Mac.

Is 18 percent APR high?

Low introductory APRs last for only a limited time before a high regular APR takes their place, for example. And an 18% regular rate won’t cost you too much for a month or two, but carrying a balance for a long time will be expensive.

Should I lock my rate today?

Closing your rate quickly can help you close your loan on time. Failing to lock your rate will delay your closing. If you miss your closing deadline on a home purchase, you could lose that home. Rates are projected to rise throughout 2022, so closing sooner will likely get you a better rate.

Will mortgage interest rates go up in 2022?

Mortgage rates have been slowly rising since the start of this year, and are expected to increase throughout 2022. While rates are above their historic records set earlier in the pandemic, they’re still relatively low. Interest rates are dynamic – they rise and fall on a daily basis due to numerous economic factors.

Will interest rates go back down in 2023?

That’s Unlikely. The Federal Reserve came on strong in its Wednesday announcement, suggesting it will raise interest rates 11 times though 2023.

What is an excellent credit score?

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What APR will I get with a 700 credit score?

Good Credit Score For Mortgages

| FICO Score | Mortgage APR | Monthly Payment |

|---|---|---|

| 700 – 759 (Good) | 4.58% | $1,279 |

| 680 – 699 (Average) | 4.76% | $1,305 |

| 660 – 679 (Poor) | 4.95% | $1,338 |

| 640 – 659 (Bad) | 5.40% | $1,404 |

• 7 janv. 2022

How do I lower my APR?

How to Get a Lower APR on Your Credit Card

- Open a credit card with an introductory 0% deal. One way to bring down the interest rate on your credit balance is to transfer it to a card with an introductory 0% promotion. …

- Look for a low-interest card. …

- See what your issuer is willing to offer. …

- Improve your credit score.

What if rates drop after I lock?

If interest rates happen to go up during the period when your rate is locked, you get to keep your lower rate. On the other hand, if you lock your rate and interest rates go down, you can’t take advantage of the lower rate unless your rate lock includes a float-down option.

What day of the week is best to lock mortgage rates?

According to data compiled from MBSQuoteline, a provider of real-time mortgage market pricing, mortgage rates are most stable on Mondays, making that day the easiest on which to lock a low rate.

Can I walk away from a rate lock?

You can back out of a mortgage rate lock, but there are consequences. Backing out of a rate lock means giving up the application you’ve put time and money into. You’ll have to start your mortgage application over from the start, and you’ll likely have to re-pay fees like the credit check and home appraisal.

Will rates go up in 2021?

But many experts forecast that rates will rise by the end of 2021. As the economy begins to reopen, the expectation is for mortgage and refinance rates to grow. But that doesn’t mean rates will shoot up overnight. So far, the increase in rates has come with ups and downs marked by a gradual rise over time.

Does Income Affect interest rates?

The back-end ratio looks at the relationship between your income and your total monthly debts — including your housing expenses. The stronger these ratios, the lower your interest rate. That’s because borrowers who have higher incomes and lower debts represent lower risks to mortgage lenders.

What will interest rates be in 2030?

Over that same period, the interest rate on 10-year Treasury notes is projected to rise gradually, reaching 3.1 percent in 2030 (see Chapter 2). Changes Since CBO’s Previous Projections.

Will interest rates rise in 2021?

You could find mortgages with around 3% interest for most of 2021, but the Mortgage Bankers Association is predicting that rates will rise to 4% this year, which could make monthly payments on mortgages more expensive.

Why are CD rates so low in 2021?

CD rates are influenced by interest rate moves by the Federal Reserve. The U.S. central bank’s key rate has been pegged at zero percent since March 2020 in an effort to stimulate the economy during the COVID-19 crisis, and subsequently, CD rates are currently low.

Is it better to close a credit card or keep it open and not use it?

In general, it’s best to keep unused credit cards open so that you benefit from a longer average credit history and a larger amount of available credit. Credit scoring models reward you for having long-standing credit accounts, and for using only a small portion of your credit limit.

Is paying off a car good for credit?

In some cases, paying off your car loan early can negatively affect your credit score. Paying off your car loan early can hurt your credit because open positive accounts have a greater impact on your credit score than closed accounts—but there are other factors to consider too.

Is Credit Karma accurate?

Here’s the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

What is the average credit score by age?

And for the first time, the average FICO ® Score of Generation X (ages 41 through 56 in 2021) is in the 700s.

…

The Average FICO ® Score Increased Among All Generations.

| Average FICO ® Score by Generation | ||

|---|---|---|

| Generation | 2020 | 2021 |

| Baby boomers (57-75) | 736 | 740 |

| Generation X (41-56) | 698 | 705 |

| Millennials (25-40) | 679 | 686 |

• 22 févr. 2022

Is 725 a Good credit score?

A 725 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Is 670 a Good FICO score?

A FICO® Score of 670 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good range.

Join TheMoney.co community and don’t forget to share this post !