Currently, there is no public market for our units, Class A common stock or warrants. We have applied to have our units listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “DWACU”.

Similarly, Whats the difference between DWAC and Dwacu?

Recall that DWAC is the Class A share ticker symbol of Digital World Acquisition Corp, while DWACU is the same equity, but with half a warrant attached. The latter shares are up less, which is a bit odd. Regardless, DWAC now sports a market cap of around $4.7 billion, per Yahoo Finance.

Is Phun a good stock? Is PHUNWARE Stock a good buy in 2022, according to Wall Street analysts? The consensus among 2 Wall Street analysts covering (NASDAQ: PHUN) stock is to Strong Buy PHUN stock.

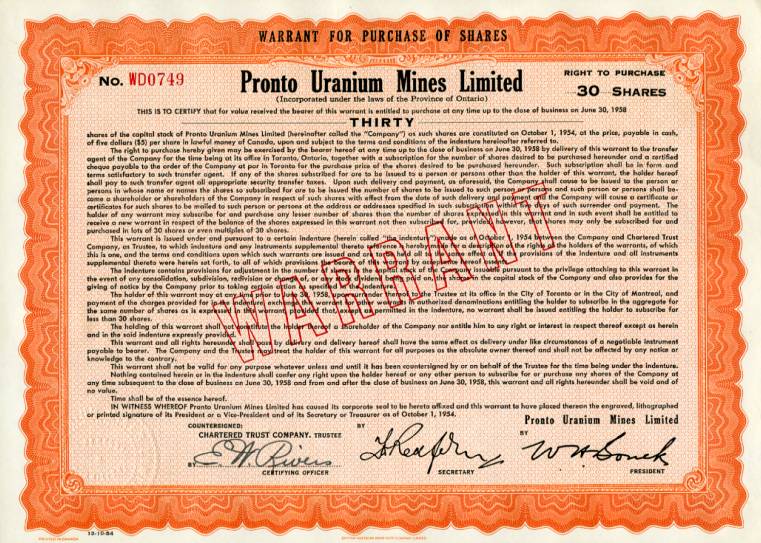

Thereof, How do I exercise stock warrants?

The easiest way to exercise a warrant is through your broker. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a dilutive effect. Warrants can be bought and sold on the secondary market up until expiry.

What is a SPAC IPO?

A special purpose acquisition company (SPAC) is a company that has no commercial operations and is formed strictly to raise capital through an initial public offering (IPO) or the purpose of acquiring or merging with an existing company.

Who owns digital world acquisitions?

Board of Directors

| Patrick Francis Orlando Chairman & Chief Executive Officer | Benessere Capital Acquisition Corp., Digital World Acquisition Corp., Maquia Capital Acquisition Corp. |

|---|---|

| Lee Jacobson Independent Director | Digital World Acquisition Corp. |

| Bruce J. Garelick Independent Director | Digital World Acquisition Corp. |

What is the exercise price of DWAC warrants?

Determining the intrinsic value of DWAC’s warrants is straightforward. That amount is $86.04, obtained by subtracting the $11.50 exercise price from the stock price of $97.54.

Is DWAC a good investment?

The consensus Author rating is 2.4, with 5 out of 10 authors calling DWAC a Sell or Strong Sell. 4 authors are neutral, while one calls DWAC a Buy. Wall Street has not covered DWAC so far, thus there are no publicized price targets.

Is cassava a buy?

Cassava Sciences’s analyst rating consensus is a ‘Moderate Buy. This is based on the ratings of 5 Wall Streets Analysts.

Is Mark stock a buy?

REMARK HOLDINGS Stock Forecast FAQ

The consensus among 1 Wall Street analyst covering (NASDAQ: MARK) stock is to Strong Buy MARK stock.

When did PHUN go public?

PHUN and PHUNW appeared on the threshold securities list for the first time on Friday, April 5, 2019.

Are warrants a good investment?

Stock warrants can last for up to 15 years, whereas stock options typically exist for a month to two to three years. Therefore, for long-term investments, stock warrants may be a better investment than stock options because of their longer terms. However, stock options may be a better short-term investment.

Can you sell warrants anytime?

The stock warrant is good up until its expiration date. After the expiration date, the warrant has expired, and the holder can no longer use it. Under an American-style stock warrant, the holder can exercise his right to buy or sell the shares at any time before the warrant expires.

Can anyone buy stock warrants?

Stock warrants, like stock options, give investors the right to buy (via a call warrant) or sell (via a put warrant) a specific stock at a certain price level (strike price) before a certain date (expiration date). Warrants are good for a fixed period of time, but they aren’t worth anything when they expire.

What is better SPAC or IPO?

Going public with a SPAC—pros

The main advantages of going public with a SPAC merger over an IPO are: Faster execution than an IPO: A SPAC merger usually occurs in 3–6 months on average, while an IPO usually takes 12–18 months.

What is the downside of a SPAC?

Cost. The cost of a SPAC IPO can be heinously expensive even though, on the face of it, it appears cheaper than a traditional IPO. Underwriters’ fees are 2% of the amount raised upfront with a further 3.5% contingent on a deal taking place. This 5.5% is less than the 7% often charged for a traditional IPO.

Are SPAC a good investment?

The Bottom Line. Because of their high risk and poor historical returns, SPACs probably aren’t a suitable investment for most individual investors. But given attention seen in 2020 and 2021, and the increase in successful SPAC IPOs, the tide may change.

How will DWAC make money?

How does TMTG make money? For all intents and purposes, an investment in DWAC is an investment in TMTG. Based upon its social media and streaming platform plans, TMTG could make money from a number of sources, including advertising, data licensing, and paid subscriptions.

What happens to DWAC after merger?

Upon a successful merger completion, DWAC shareholders will become shareholders in the public company TMTG. All of the trading in DWAC shares is based on speculation regarding the timing of the closing of the merger.

Can DWAC stock be shorted?

Unless investors currently own or are shorting DWAC stock, now is a risky time to buy and an expensive time to short. For those who currently own the stock, it may be wise to sell before the merger, and shares could be bought again post-VWAP period.

How do I buy a warrant?

The easiest way to exercise a warrant is through your broker. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a dilutive effect. Warrants can be bought and sold on the secondary market up until expiry.

Join TheMoney.co community and don’t forget to share this post !