The composite rate for I bonds issued from November 2021 through April 2022 is 7.12 percent. This rate applies for the first six months you own the bond.

Similarly, Are Treasury bonds a good investment?

Treasury bonds can be a good investment for those looking for safety and a fixed rate of interest that’s paid semiannually until the bond’s maturity. Bonds are an important piece of an investment portfolio’s asset allocation since the steady return from bonds helps offset the volatility of equity prices.

How much is a $100 savings bond worth? (Series I paper bonds are limited to $5,000.) You will pay half the price of the face value of the bond. For example, you’ll pay $50 for a $100 bond. Once you have the bond, you choose how long to hold onto it for — anywhere between one and 30 years.

Thereof, How do US Treasury bonds work?

How I bonds work. I bonds, backed by the U.S. government, won’t lose value and pay interest based on two parts, a fixed rate and a variable rate, changing every six months based on the consumer price index.

Are bonds a good investment in 2021?

2021 will not go down in history as a banner year for bonds. After several years in which the Bloomberg Barclays US Aggregate Bond Index delivered strong returns, the index and many mutual funds and ETFs that hold high-quality corporate bonds are likely to post negative returns for the year.

What is the current 7 year Treasury rate?

7 Year Treasury Rate is at 2.84%, compared to 2.71% the previous market day and 1.31% last year.

Will bonds go up in 2022?

In an environment of rising interest rates and healthy economic growth, we continue to favor high-yield corporate bonds. There’s been virtually nowhere for investors to hide in 2022, with losses across the board in both bond and stock markets.

Why are bonds losing money right now?

Right now, fixed income is outperforming stocks by being less negative on a relative basis. Right now, like always, there are multiple narratives at play in the markets. But the primary reason bonds are down this year is because the Federal Reserve is going to be raising rates.

Is now a good time to buy bonds 2022?

Bond prices move in the opposite direction of interest rates. If interest rates rise, bond prices fall, and vice versa. The Federal Reserve has indicated it will be raising interest rates in 2022 and slowing its purchase of bonds, so the climate is likely to be less favorable for long-term bonds going forward.

How do I buy US Treasury bonds?

You can buy short-term Treasury bills on TreasuryDirect, the U.S. government’s portal for buying U.S. Treasuries. Short-term Treasury bills can also be bought and sold through a bank or broker. If you do not hold your Treasuries until maturity, the only way to sell them is through a bank or broker.

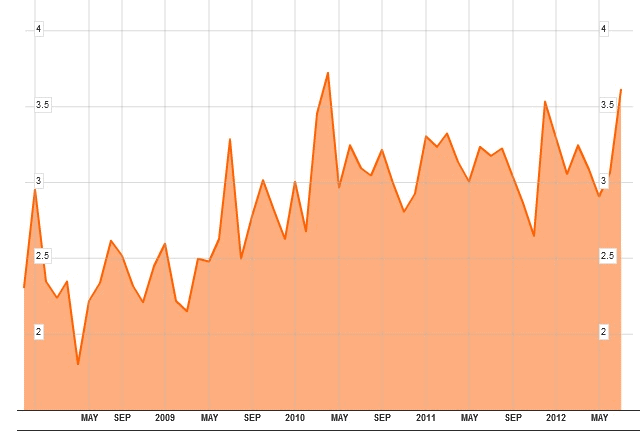

What is the 5 year CMT?

Five-Year Treasury Constant Maturity

What it means: An index published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to the equivalent of a five-year maturity.

What is the 5 year Treasury rate today?

5 Year Treasury Rate is at 2.79%, compared to 2.66% the previous market day and 0.87% last year. This is lower than the long term average of 3.74%.

What bonds should I buy for 2022?

3 U.S. Bond Funds To Buy For Yield And Stability In 2022

- Vanguard Total Bond Market ETF (NASDAQ:BND)

- Fidelity Investment Grade Bond Fund (MUTF:FBNDX)

- Schwab Tax-Free Bond Fund (MUTF:SWNTX)

Why are bond funds going down now 2022?

The culprit for the sharp decline in bond values is the rise in interest rates that accelerated throughout fixed-income markets in 2022, as inflation took off. Bond yields (a.k.a. interest rates) and prices move in opposite directions. The interest rate rise has been expected by bond market mavens for years.

What will I bond rates be in 2022?

An 8.54% return is guaranteed by the U.S. Treasury

With inflation increasing to multi-decade highs the inflation calculation for I bonds bought until April 30, 2022, pays an annualized rate of 7.12% for six months.

Why are bonds down in 2022?

The culprit for the sharp decline in bond values is the rise in interest rates that accelerated throughout fixed-income markets in 2022, as inflation took off. Bond yields (a.k.a. interest rates) and prices move in opposite directions. The interest rate rise has been expected by bond market mavens for years.

What happens to bonds in stock market crash?

Bonds affect the stock market because when bonds go down, stock prices tend to go up. The opposite also happens: when bond prices go up, stock prices tend to go down. Bonds compete with stocks for investors’ dollars because bonds are often considered safer than stocks. However, bonds usually offer lower returns.

Are I bonds a good investment 2020?

Best investment for

Like other government-issued debt, Series I bonds are attractive for risk-averse investors who do not want to run any risk of default. These bonds are also a good option for investors who want to protect their investment against inflation.

How do I buy a 10 year Treasury bond?

5 The U.S. Treasury sells 10-year notes and those with shorter maturities, as well as T-bills and bonds, directly through the TreasuryDirect website via competitive or noncompetitive bidding, with a minimum purchase of $100 and in $100 increments. Treasury securities can also be purchased through a bank or broker.

Should I buy bonds when interest rates are low?

In low-interest rate environments, bonds may become less attractive to investors than other asset classes. Bonds, especially government-backed bonds, typically have lower yields, but these returns are more consistent and reliable over a number of years than stocks, making them appealing to some investors.

Are bonds better than savings accounts?

Their biggest advantage is that their regular interest payments are much larger than savings accounts. Additionally, the interest rate on a bond is guaranteed once you buy it. If you are nearing retirement, or want to turn a lump sum of cash into an income stream, bonds are the way to go.

How do I buy a 2 year Treasury bond?

You can buy notes from us in TreasuryDirect. You also can buy them through a bank or broker. (We no longer sell notes in Legacy Treasury Direct, which we are phasing out.) You can hold a note until it matures or sell it before it matures.

What is the 1 year Treasury rate?

1 Year Treasury Rate is at 1.84%, compared to 1.78% the previous market day and 0.06% last year.

What is the yield on 3 month Treasury bills?

Treasury Yield Curve

| 1 Month Treasury Rate | 0.37% |

|---|---|

| 10 Year-3 Month Treasury Yield Spread | 2.04% |

| 10-2 Year Treasury Yield Spread | 0.36% |

| 20 Year Treasury Rate | 3.09% |

| 3 Month Treasury Rate | 0.79% |

Join TheMoney.co community and don’t forget to share this post !