5-for-1 split ratio: In a 5-for-1 stock split, each individual share of stock is split into five shares. The market price of those five new shares is one-fifth the price of the old share.

Similarly, Is it better to buy before or after a stock split?

The split may elicit additional interest in the company’s stock, but fundamentally investors are no better or worse off than before, since the market value of their holdings stays the same.

Does stock price go up after split? Stock splits divide a company’s shares into more shares, which in turn lowers a share’s price and increases the number of shares available. For existing shareholders of that company’s stock, this means that they’ll receive additional shares for every one share that they already hold.

Thereof, Do stock splits cause stock prices to fall?

A stock’s price is also affected by a stock split. After a split, the stock price will be reduced (because the number of shares outstanding has increased). In the example of a 2-for-1 split, the share price will be halved.

What stocks will split in 2022?

Nine U.S. companies have a share price greater than $1,000. Three of them plan splits in 2022.

| Company / Ticker | Recent Price | Market Value (bil) |

|---|---|---|

| AutoZone / AZO | $2,041.39 | $41 |

| Chipotle Mexican Grill / CMG | $1,605.23 | $45 |

| Mettler-Toledo International / MTD | $1,348.16 | $31 |

| Tesla / TSLA ** | $1,091.26 | $1,128 |

• 8 avr. 2022

Should you sell before a stock split?

If you believe that a stock will continue going up after a split, you may want to sell it long enough before the split that you can buy it back before it splits. Doing this can be a good strategy if the stock is appreciated and you can sell other losses to cancel it out.

What are advantages of a stock split?

Stock splits can improve trading liquidity and make the stock seem more affordable. In a stock split the number of outstanding shares increases and the price per share decreases proportionately, while the market capitalization and the value of the company do not change.

Should I sell before a stock split?

If you believe that a stock will continue going up after a split, you may want to sell it long enough before the split that you can buy it back before it splits. Doing this can be a good strategy if the stock is appreciated and you can sell other losses to cancel it out.

What are the disadvantages of a stock split?

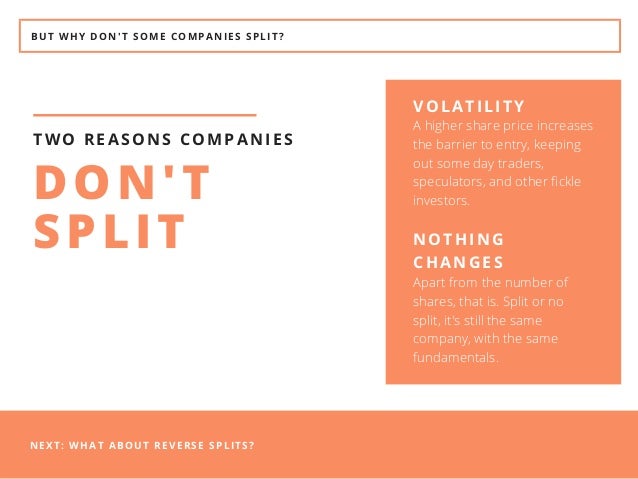

Disadvantages of Stock Splits

- They Don’t Change Fundamentals. Stock splits don’t affect the fundamentals and therefore the value of a company. …

- Stock Splits Cost Money. …

- They May Attract the Wrong Type of Investor.

What happens when a stock splits 20 to 1?

A 20-1 stock split means that each share of Amazon today will turn into 20 shares, 1 existing one and 19 additional ones, following the stock split. Someone holding 10 shares today would own 200 shares in Amazon following the stock split.

Will Amazon do a share split?

Amazon ( AMZN -2.46% ) recently announced a 20-for-1 stock split. Shareholders of record at the market close on May 27 will receive 19 additional shares for every share they own. The split will go into effect on June 6.

Has Amazon ever had a stock split?

Three stock splits

They all happened in the period of 1998 through 1999. The last took place on Sept. 2, 1999.

What happens when a stock splits 4 to 1?

If you owned 1 share of Example Company valued at $700 per share, your investment would have a total value of $700 (price per share x amount of shares held). At the time the company completed the 4-for-1 forward split, you would now own 4 shares valued at $175 per share, resulting in a total value invested of $700.

What stocks could split in 2021?

Eight companies that could issue the next stock splits:

- Booking Holdings Inc. (BKNG)

- Markel Corp. (MKL)

- Tesla Inc. (TSLA)

- Equinix Inc. (EQIX)

- BlackRock Inc. (BLK)

- O’Reilly Automotive Inc. (ORLY)

- Alleghany Corp. (Y)

- ASML Holding NV (ASML)

Will Tesla split again in 2022?

When would the stock split? Not until after the 2022 annual shareholder meeting. If that’s in October, that means Tesla stock wouldn’t split until the end of the year at the earliest.

Which company will give bonus share in 2021?

Bonus

| COMPANY | Bonus Ratio | DATE |

|---|---|---|

| Apollo Tricoat | 1:1 | 16-09-2021 |

| APL Apollo | 1:1 | 16-09-2021 |

| Kanpur Plast | 1:2 | 15-09-2021 |

| Mahindra Life | 2:1 | 14-09-2021 |

What usually happens to a stock after a split?

The stock price is adjusted by the exchange when the split takes place. For example, if a stock is trading at $40 a share before the 2-for-1 split, it will be adjusted to $20 a share after the split.

Do stock splits make you richer?

A stock split doesn’t make investors rich. In fact, the company’s market capitalization, equal to shares outstanding multiplied by the price per share, isn’t affected by a stock split. If the number of shares increases, the share price will decrease by a proportional amount.

Is there a downside to stock splits?

Downsides of stock splits include increased volatility, record-keeping challenges, low price risks and increased costs.

What is the downside of a stock split?

The stock’s value doesn’t change at all, but the lower stock price can affect how the stock looks and therefore gain new investors. When the stock is split, it makes current shareholders think they have more shares than they previously did. If the price increases, they’ll also think they have more stock they can trade.

What are the pros and cons of splitting stock?

Advantages of Stock Splits

- Stock Splits Increase Liquidity.

- Stock Splits Prevent Too High Prices.

- They Allow Companies to Send Positive Signals.

- They Don’t Change Fundamentals.

- Stock Splits Cost Money.

- They May Attract the Wrong Type of Investor.

Join TheMoney.co community and don’t forget to share this post !