Stock pricing differences during extended-hours trading

Typically, price changes in the after-hours market have the same effect on a stock that changes in the regular market do: A $1 increase in the after-hours market is the same as a $1 increase in the regular market.

Similarly, Can I sell stock after hours?

Can I use a market order to trade a stock after hours? No, a market order cannot be used in after-hours trading. Most brokerage firms only accept limit orders in after-hours trading to protect investors from unexpectedly bad prices that may result from the lower trading volumes and wider spreads during this session.

Why do stocks spike after hours? Stocks move after hours because many brokerages allow traders to place trades outside of normal market hours. Every trade has the potential to move the price, regardless of when the trade takes place.

Thereof, Can I sell my stock on Saturday?

Traditionally, the markets are open from 9:30 AM ET – 4 PM ET during normal business days (Monday – Friday, no bank holidays). This means that any weekend orders you place to invest in stocks or ETFs will be queued to process when the market opens on the next trading day.

Can I sell stock over the weekend?

While it isn’t possible to trade on the weekend with the NYSE or NASDAQ stock markets, it is possible to trade on the weekends through other means. Both the NYSE and NASDAQ markets offer pre-and after-hour trading, but this is usually exclusive. As with all investing, there is some risk to buying stock on the weekend.

Can I buy stock one day and sell the next?

There are no restrictions on placing multiple buy orders to buy the same stock more than once in a day, and you can place multiple sell orders to sell the same stock in a single day. The FINRA restrictions only apply to buying and selling the same stock within the designated five-trading-day period.

Should you buy stocks after hours?

But after-hours trading both enhances the standard risks of the market and introduces additional risks. The major risks of after-hours trading are: Low liquidity. Trade volume is much lower after business hours, which means you won’t be able to buy and sell as easily, and prices are more volatile.

How can I buy shares after zero hours in trading?

You can place orders for the next trading day using the AMO feature on Kite. This is especially helpful for people who can’t actively track the markets during the live session – 9:15 am to 3:30 pm. AMO orders are allowed for all product types (CNC/MIS/NRML) except for CO.

What is the largest one day stock gain?

What Is the Biggest Gain a Stock Has Ever Experienced? Only one day after Meta Platforms experienced the largest single-day stock market loss in history, Amazon (AMZN) clawed back 14% and posted the single largest one-day gain in U.S. stock market history.

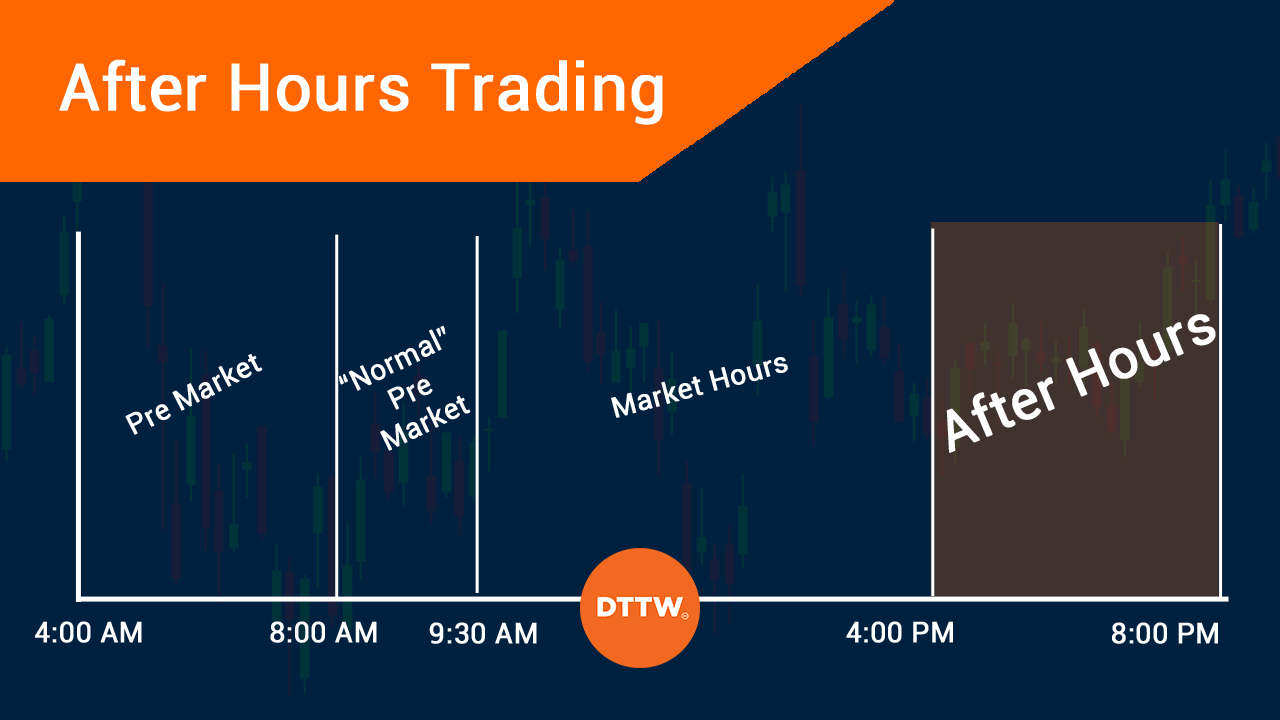

How can I trade at 4am?

To be sure, online trading platforms — including TD Ameritrade — let clients trade in the premarket session (4 a.m. ET to 9:30 a.m. ET) and after-hours (4 p.m. ET to 8 p.m. ET).

Can you buy stock and sell it the next day?

Retail investors who want to avoid day trading rules may purchase stocks at the end of the day, so they are free to sell them the next day if they wish.

Should you buy stocks on Friday?

If you’re interested in short selling, then Friday may be the best day to take a short position (if stocks are priced higher on Friday), and Monday would be the best day to cover your short. In the United States, Fridays on the eve of three-day weekends tend to be especially good.

Why do stocks fall on Mondays?

Stock prices fall on Mondays, following a rise on the previous trading day (usually Friday). This timing translates to a recurrent low or negative average return from Friday to Monday in the stock market.

Should you buy stocks on Friday?

But historically, many studies have shown that prices typically drop on Mondays, making that often one of the best days to buy stocks. Friday, usually the last trading day before the Monday drops, is therefore one of the best days to sell.

Can I buy and sell Crypto on Robinhood same day?

You can day trade crypto on Robinhood as easily as you can stocks, ETFs, and options. The only difference is that there are no trading hours for cryptocurrency. You can trade crypto on Robinhood any time of the day or night—there are no restricted trading hours.

What happens if you get flagged as a day trader?

If you day trade while marked as a pattern day trader, and ended the previous trading day below the $25,000 equity requirement, you will be issued a day trade violation and be restricted from purchasing (stocks or options with Robinhood Financial and cryptocurrency with Robinhood Crypto) for 90 days.

Is day trading illegal?

Day Trading? Day trading is neither illegal nor unethical. However, day trading strategies are very complex and best left to professionals or savvy investors.

Why do day traders fail?

Most traders fail due to a lack of experience and knowledge on the stock market, a trading plan, poorly managing their risks, and trading irrationally. Also, setting unrealistic goals, being sloppy, reinforcing random strategies, and ignoring marketing changes will lead to failure.

What happens if I buy stock after hours and price goes up?

Higher Spread. Generally, the more buyers and sellers are actively trading a stock, the narrower the spread will be. Because spreads tend to be wider during after-hours trading, you are likely to pay more for shares than during regular hours.

Why do stocks go up after hours?

Stocks move after hours because many brokerages allow traders to place trades outside of normal market hours. Every trade has the potential to move the price, regardless of when the trade takes place.

Does TD Ameritrade allow after-hours trading?

24/5 Trading. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week (excluding market holidays).

Join TheMoney.co community and don’t forget to share this post !